“The thing about investing is that there’ll never be a perfect time to start… Again, the goal here is not to rope yourself with needless pressure. You should simply start with what you have, where you are. It always gets better.”

It’s a new year and typically, there are loads of contents ranging from videos and blog posts on investment littered all around the internet. Unfortunately, this is another one, although written differently. I’ll share with you at least 5 investments I’m making this year – which you should likewise and how to go about them.

WARNING: This is not a piece of financial advice, so let’s all be guided. I’m not your financial advisor.

1. Personal Development

It was Robin Sharma that said, “to double your income, triple your investment in yourself”. This has to be the most important investment you will make in 2022. Any investment in yourself will always yield at least 10x in return. I don’t know any asset class that promises such MoM return as personal development, and the best part is it’s really easy to start. There’s really nothing complex, you simply start with what you have, where you are. It could be a book, online course, YouTube video, Twitter Spaces or ClubHouse room. It doesn’t have to be that $400+/mo. Udacity nano degree or $3k Harvard/INSEAD online executive program. (Although, I’d totally recommend them if you’re a senior hire) Just start with what you have.

Interestingly, one overlooked option is optimising one’s social media feeds. In 2020, I realised I’d spent quite a number of hours on social media and decided to optimise my feeds for personal development, so I felt less guilty. (I lied. I read Cal Newport’s Deep Work and got guilt-tripped into quitting social media.) One simple hack that I have found very useful is rather than send connection requests on LinkedIn, I rather “follow” people whose contents are educative or who I’m interested in learning much closely from. That way, I get to see their updates and learn for free without being a connection (or bearing the ignominy of not being found worthy to join their connection.)

Nevertheless, I also recommend structured learning – especially professional courses and certifications. This year, I’m taking paid courses//certifications on; FinTeh, Product Management, Project Management, Business Strategy, Financial Management for Executives and Managing People & Operations.

Generally, read very broadly. Are you confused about which books to get started with? You can check out my Reading List for 2022 and 2021 to get a few titles you might find interesting.

Lastly, I know it’s cliche but I don’t think you should invest any of your money in any asset class if you haven’t invested in researching and reading up about it. You are most likely going to lose money.

2. Stocks/ETFs

The thing about investing in stocks is that there’ll never be a perfect time to start. I remembered late 2021 when MTN announced its public offer, I literally procrastinated till the last day before getting a few units. My excuse? “I didn’t have cash”, “Is investing in NG stocks really a great idea?”, “Who else do I know is getting them?” Till I almost missed it. Again, the goal here is not to rope yourself with needless pressure. You simply should start with what you have, where you are. It always gets better.

My rule of thumb on investing in stocks is quite simple; “if I must consume it, I must own a portion of it, at least.”

I have shortlisted a few stocks and ETFs that I’ll be getting this year – just 10 of them. You can always start out with Trove, Bamboo or Chaka for easy investment in US, NG, China stocks.

For top ETFs to invest in check here for top ETFs, while you can find a list of stocks to invest in here. Happy Investing!

3. Real Estate

Another asset I totally recommend you invest in 2022 is getting a piece of real estate – land, apartment, anything. Like every other asset class, I’ve got an advisor who pretty much advises me and sometimes upsells.

However, for beginners, I recommend Rise and Bongalow if you’re interested in investing in real estate.

4. Crypto/NFT:

Truth is, I don’t know much about this assets class. This is one controversial asset class that I’m yet to fully understand. For anything in my experience, humans tend to criticise what they do not understand or are scared of. Whichever, I’m taking out time this quarter to read more on Crypto/NFTs. Nonetheless, this is my simple rule; don’t invest money in crypto that you’re not willing to lose. You can start out with Binance.

5. Agriculture/Commodities:

Last year, a friend spoke to me about how he was involved in commodity trading and further ran a few numbers with me. Prior, I’d heard about this but I was still very much ignorant about how it worked. This year, I’ll be checking it out and I recommend you do. Furthermore, new research from Vanguard suggests that investing in commodities is the most powerful way to hedge against unexpected inflation.

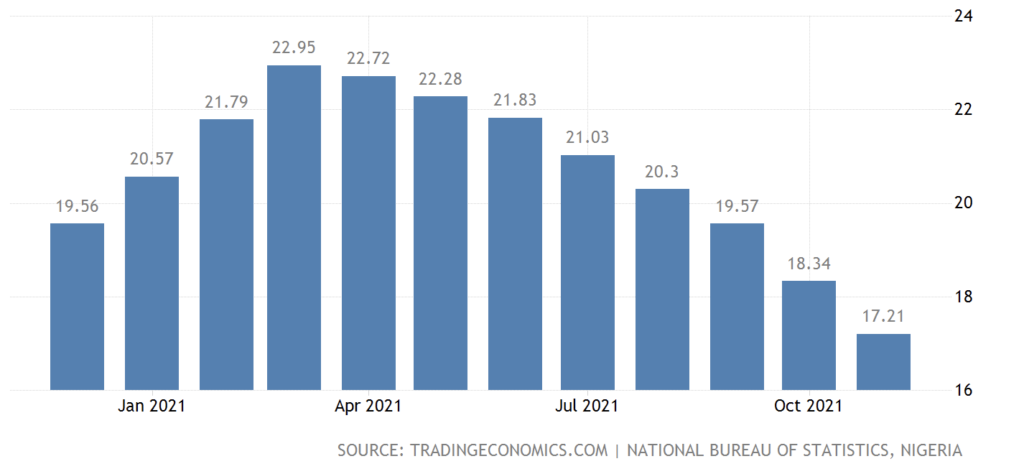

According to the Nigerian Bureau of Statistics; the Cost of food in Nigeria increased 17.21% in November of 2021 over the same month in the previous year. Not a great stat, but you get the point.

These are the lists of investments I’m making in 2022. Which resonate most with you and which would you be investing in? Leave a comment.